Earlier this month we gathered liquidity experts from major Nordic institutions to discuss the current state of liquidity management. As one of our guests explained, in the general economy it’s certainly true that money makes the world go round – but in wholesale banking and capital markets, everything rests on liquidity.

Effective liquidity management is an essential priority for every financial institution. By ensuring they have a full picture of their liquidity position, and by ingesting data and signals that help them to build intelligence about their counterparties and the market as a whole, financial services businesses can build resilience and thrive in uncertain conditions.

Nassim Nicholas Taleb, the High Priest of Uncertainty, famously coined the phrase ‘Black Swan event’ back in the mid-2000s. In one sense, his timing couldn’t have been better – the 2008 Great Financial Crash helped to immediately mainstream the idea of Black Swans, while simultaneously shattering the myth of the financial markets as fully self-righting mechanisms. The GFC did not, of course, come from nowhere, and the financial sector as a whole has made huge efforts to establish better controls to minimise the chance of a re-run of 2008. Liquidity management has been at the heart of regulators’ activities ever since, beginning with Basel III.

But despite this, liquidity is still not well understood – and liquidity illiteracy spells catastrophe, as can be seen in multiple institutional failures even over the past few months. In March 2023, Credit Suisse’s long-term problems culminated in an old-school bank run and CS’s sudden inability to fund itself in the wholesale markets. The upshot was the end of a bank that had existed in that form for nearly two centuries.

Just a few weeks prior to that, Silicon Valley Bank suffered an even worse fate as a combination of a liquidity crisis and poor risk management practices forced regulators to close the institution entirely. And in October 2022, following the UK government’s disastrous mini-budget of the previous month, the Bank of England was forced to intervene to prevent the collapse of pension funds that were unable to meet margin calls.

In short, then, liquidity is both the lifeblood of financial institutions and one of its most pressing concerns. This is not an abstract problem – it is one that claims scalps quickly and regularly. And as the industry moves towards a standard T+1 settlement cycle, while simultaneously working out how to deal sensibly and safely with the explosion of digital assets and the increasing cost of liquidity itself, the immediate future looks pretty fraught. Indeed, T+1 has proven to be the impetus that many institutions needed to refocus their efforts on liquidity. Amongst attendees at our Nordics summit, three-quarters (73%) said they are actively working on preparations for T+1, that they have identified the tools they need, and that they are in the process of implementing them.

Data means insight

Given that financial institutions are essentially data businesses, it makes sense that they should have a comprehensive understanding of the metrics with which they can understand their own liquidity positions. Attendees at our summit agreed, at least to an extent; 85% said they have identified and documented the liquidity KPIs that are core for governance.

But as we drilled deeper into the specifics of liquidity resilience, the picture became less clear.

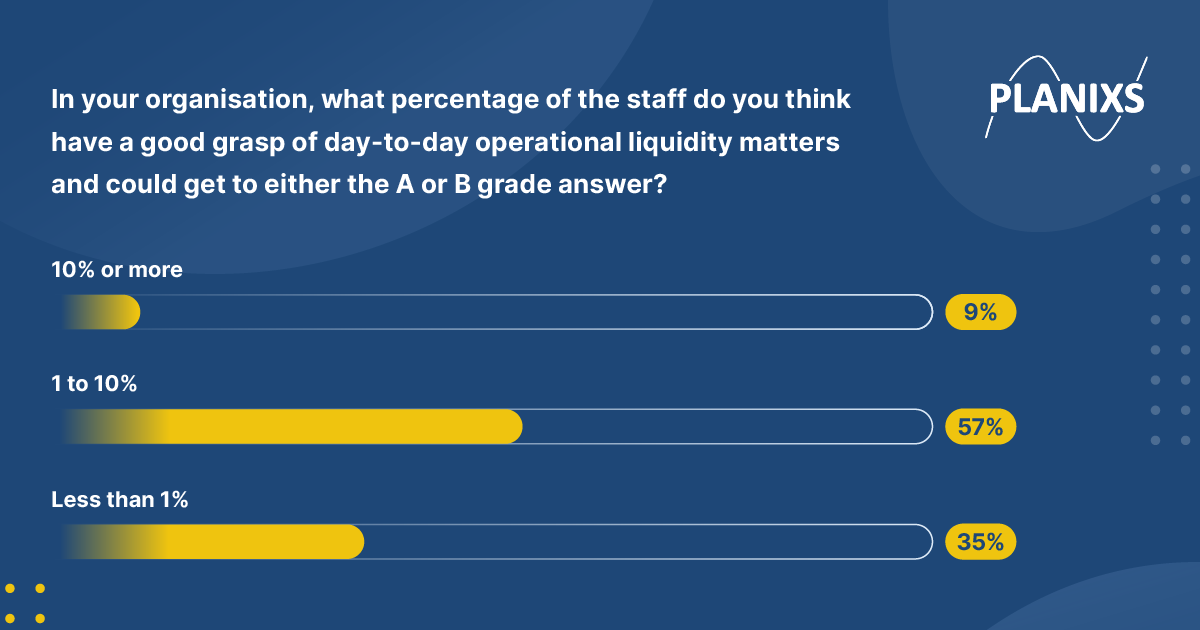

Olaf Ransome, Planixs’ Liquidity Futurologist, related a conversation with a senior short-term interest rate (STIR) trader who admitted that in their company of 90,000 people, less than 0.01% could be said to have a good grasp on the subject. Our summit attendees agreed; 57% of respondents said that only between 1% and 10% of staff in their organisation could be said to have a good grasp of day-to-day operational liquidity matters. Worryingly, more than one-third (35%) said the number was less than 1%.

The journey to liquidity insight

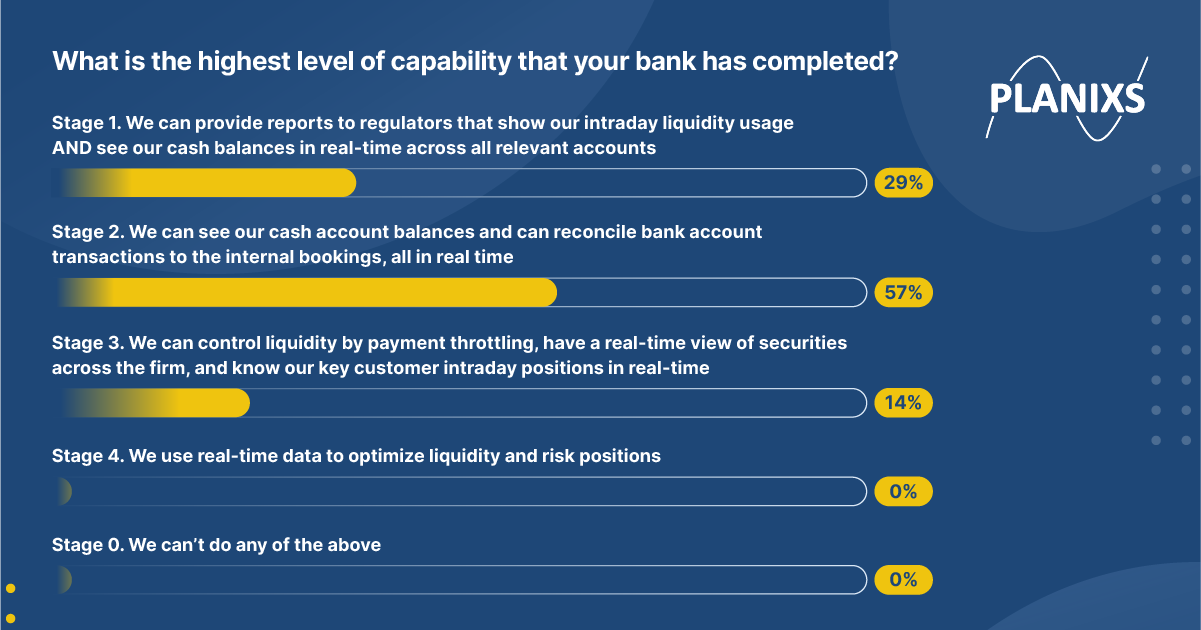

Regulators have done their bit to drive a more intense focus on liquidity, beginning in the aftermath of the GFC with the introduction of Basel III and its more stringent controls on intraday numbers. We might refer to this as Stage 1 in a four-stage evolution of liquidity controls.

Since then, institutions have gained access to a significant body of new information and new suites of tools that can, for the first time, provide real-time oversight of cash movements. We refer to this as Stage 2.

In Stage 3 of this evolution, banks can augment this data with operational controls to achieve a stronger grasp of their liquidity position. For example, they might throttle payments to control flows of cash, or introduce per-customer controls for large corporates or institutions whose activities significantly impact the bank’s intraday usage.

So what’s Stage 4 in the liquidity control journey? This stage represents the current best-practice approach to liquidity in banks and FIs. It doesn’t simply treat liquidity as a risk to be managed, but instead sees it as an asset to be maximised. Through the application of real-time data and monitoring, banks and other institutions can use their liquidity position as a ‘golden key’ to unlock growth in other areas.

Despite an understanding of the importance of liquidity-related resilience, and particularly preparation for Black Swans, responses from attendees at our Nordics summit suggested that concrete processes and practices are still lacking. When asked which stage of organisational competence their firms had reached, more than half of respondents said that they were still only at Stage 2. None of those who responded had achieved the capabilities associated with Stage 4, and just 14% were at Stage 3.

Value creation through liquidity management

To date, the focus in liquidity management has been on gaining control over flows and metrics that are of particular relevance to the business in question. Generally speaking, this begins with cash, but that is absolutely not the end of the story. To create a comprehensive, useful picture of their liquidity position, institutions should also incorporate information on securities, customer usage, and many other metrics specific to the business in question.

Importantly, not all those metrics will come from within the business. Certainly, it is important to track the sorts of flows that we’ve discussed above, and these will be the core of any liquidity management practice. But there are many extraneous signals that are highly valuable and without which a full liquidity picture cannot be painted.

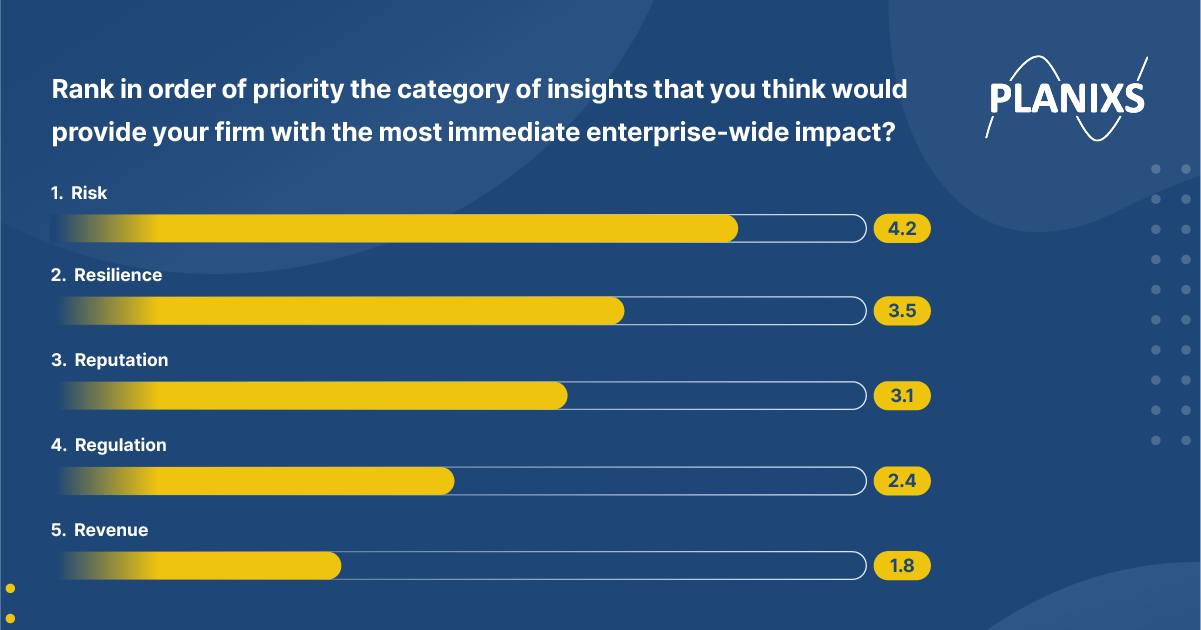

There is widespread understanding of the importance of the insights that can be generated through the effective use of data. Amongst attendees at our Nordics summit, better insight into risk was the most commonly-cited enterprise-wide impact, followed by resilience and reputation.

As understanding in this field grows, and as the pressure of T+1 encourages firms to double down on their liquidity practices, demand for more and better data is growing too. Especially in large institutions the siloing of information remains a big problem, and bridging disparate pieces of data across multiple functions is one of the major hurdles on the journey to better oversight – especially when much of that data, from CDS spreads right the way down to social media sentiment, is coming from sources outside the business itself. But once those bridges have been built, the possibilities are truly endless. By combining new pools of liquidity data with other signals and metrics from across the business, institutions can generate extremely valuable new insights that can help to minimise costs, streamline processes, and increase margins.