Smart liquidity management software for banks and financial institutions

Planixs’ Realiti platform is a powerful platform that sits alongside your existing systems and aggregates all your cash and securities information in real time. This eliminates data silos and automates many of your liquidity management processes.

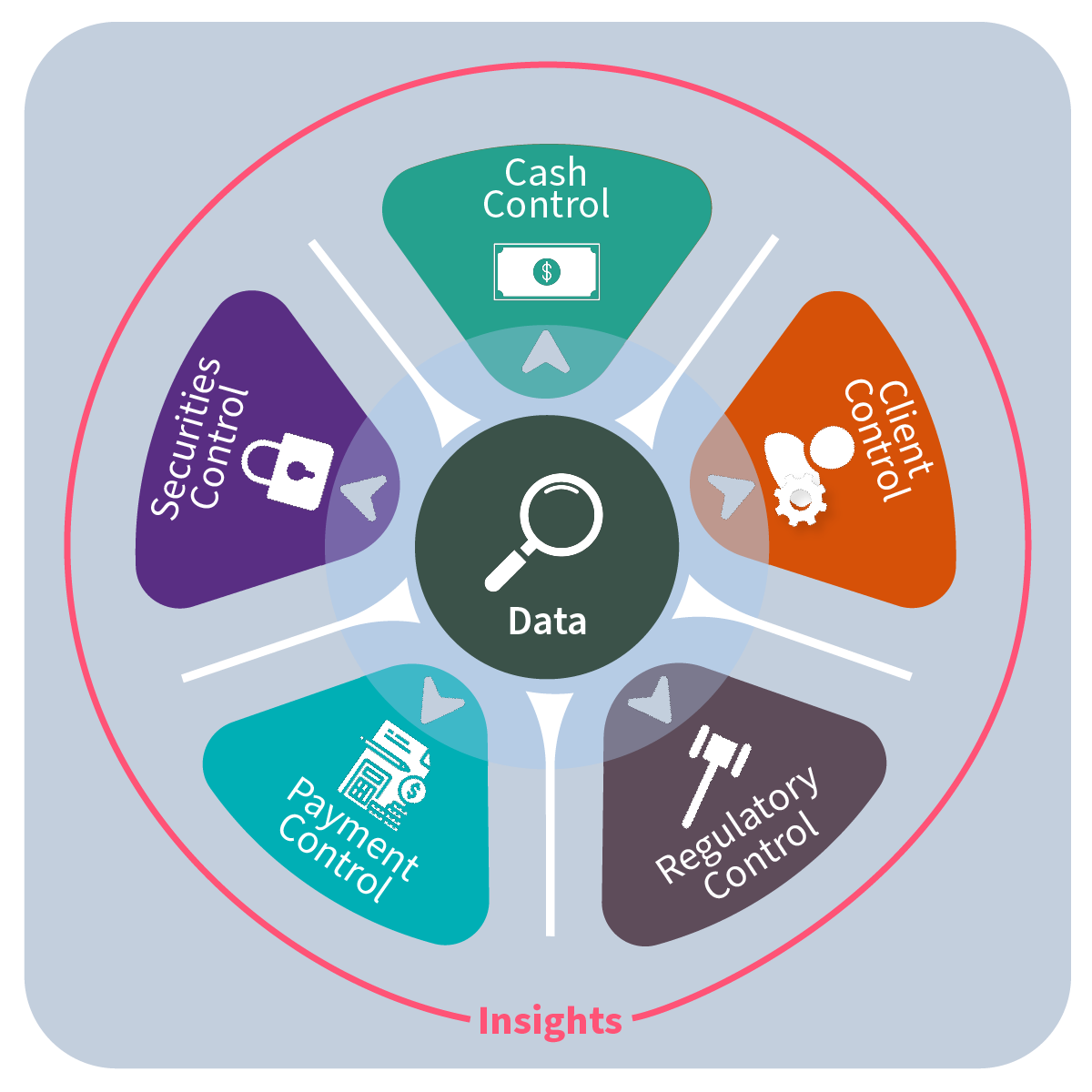

Select the Realiti Control capabilities you need

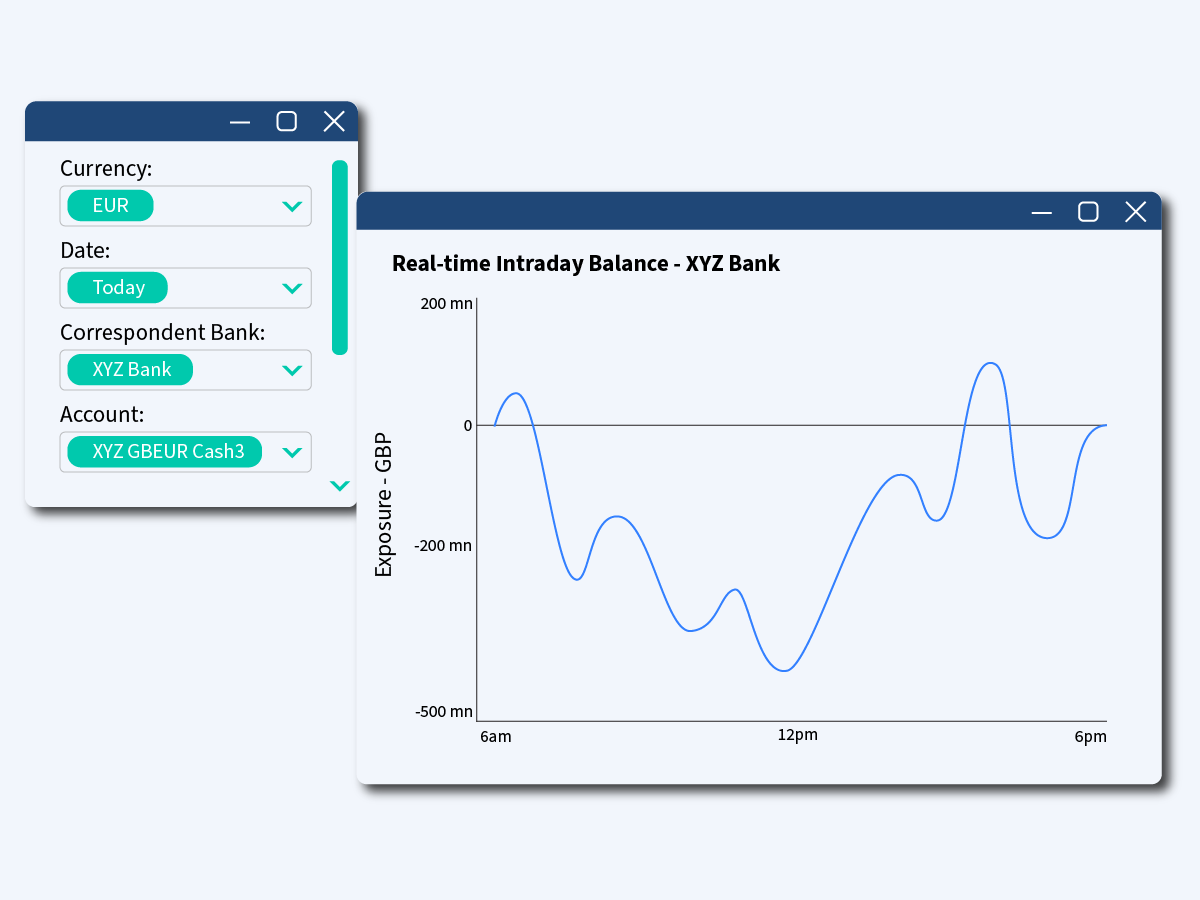

Cash Control

Cash Control centralises monitoring for all your direct and indirect accounts. It generates alerts for critical balance thresholds and integrates settlement confirmations with projected cash flows. This allows for real-time reconciliation, forecasting liquidity, providing early warnings, and optimising planning.

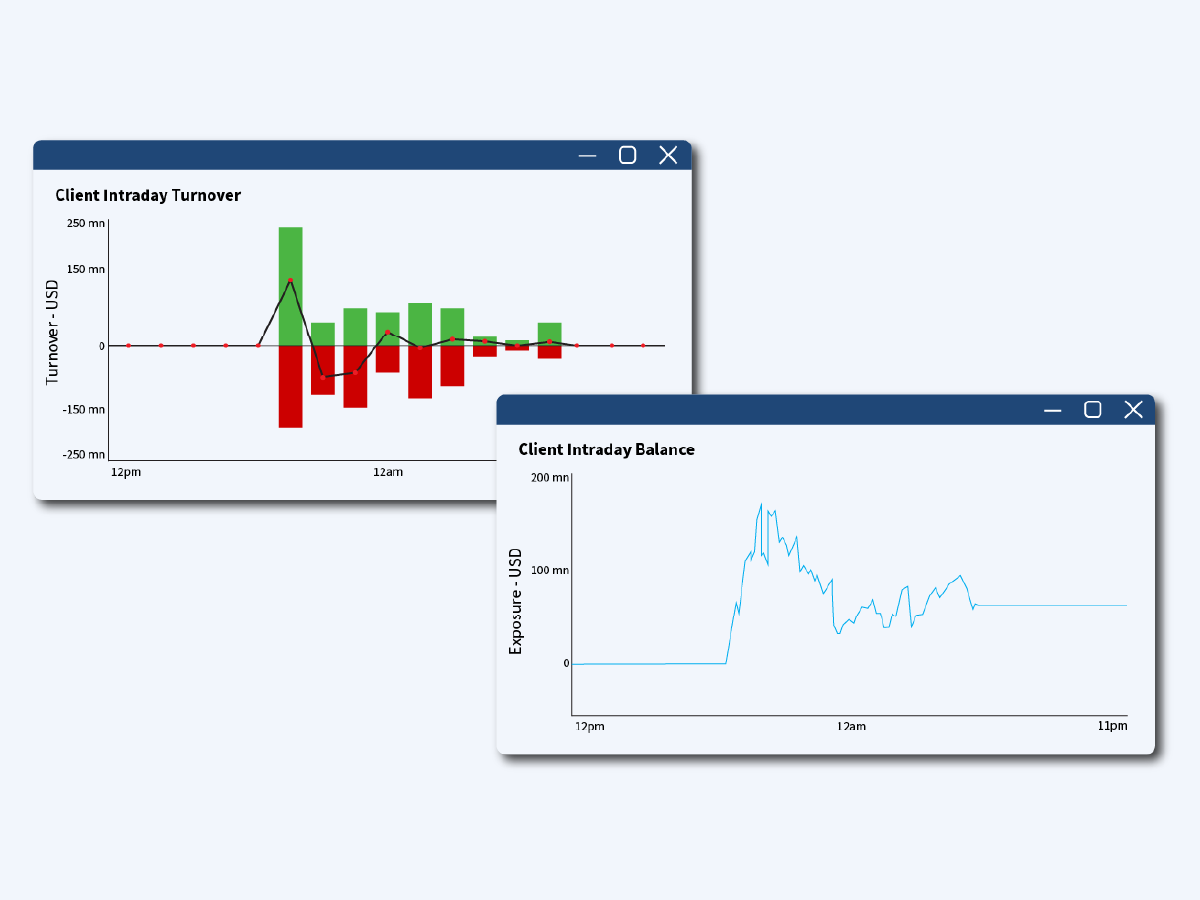

Client Control

Client Control builds intraday profiles for client accounts, providing insight into typical client behaviour. This assists with end of day funding decisions and identifies clients whose intraday behaviour could be optimised.

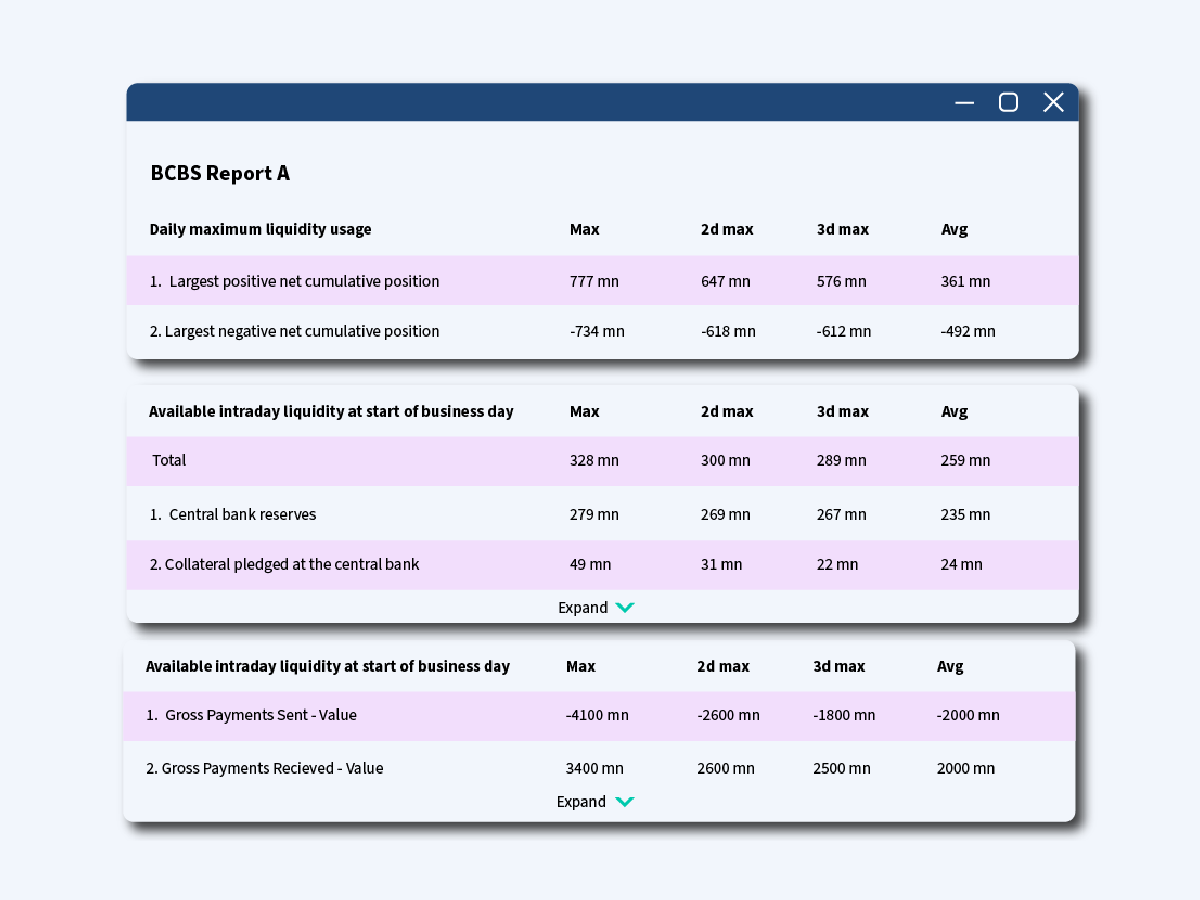

Regulatory Control

Regulatory Control uses the liquidity data generated in Cash Control to provide reports that comply with a range of regulatory agendas including BCBS 248. It allows you to apply stresses to your liquidity data and see impacts of changes to payment behaviours and restrictions on credit lines and collateral.

Payment Control

Payment Control uses real-time liquidity data, coordinating with bank gateways to withhold payments when liquidity falls below user-set limits. Low-priority payments are slowed to preserve liquidity for high-priority ones, automatically resuming when liquidity improves.

Securities Control

Securities Control extends the intraday model to the securities held in depot accounts at external venues. You get a cross-firm view of the firm’s securities assets and answers to the following questions: what do we have, where is it, how much is it worth right now (including the impact of haircuts), is it available for me to use?

High performance, scalable, seamless solution

Realiti’s intelligent software, with its high-performance and scalable architecture, can be implemented with minimal intrusion into a bank’s infrastructure. This ensures that we can cater to financial institutions of any size, and rapidly deliver substantial business value.

You also get Realiti Insights for super-smart data analytics

Insights gives you full access to the rich, real-time data generated by your Control capabilities. You can analyse liquidity drivers, interrogate risks and respond to regulatory requests. You can integrate additional data – like prices, external risk measures, and financial models. The largest global banks invest $100 millions to create systems like this, now Realiti offers all banks similar analytics capabilities at a much lower cost.