Intraday liquidity defined

Intraday Liquidity (IDL) is the capacity required during the business day to enable financial institutions to make payments and settle securities obligations.

Current situation

Changes in market dynamics, like shorter settlement times and the instant settlement of payments, are increasing the emphasis on intraday liquidity management. Financial institutions are now required to demonstrate real-time control and understanding of their liquidity. This regulatory focus has intensified following recent market disruptions, underscoring the critical importance of robust liquidity practices.

“Sound day-to-day liquidity management is high up on regulators’ priority list, after last year’s mini banking crisis.”

Blake Evans-Pritchard, FT’s Banking Risk and Regulation, 2024

The challenge

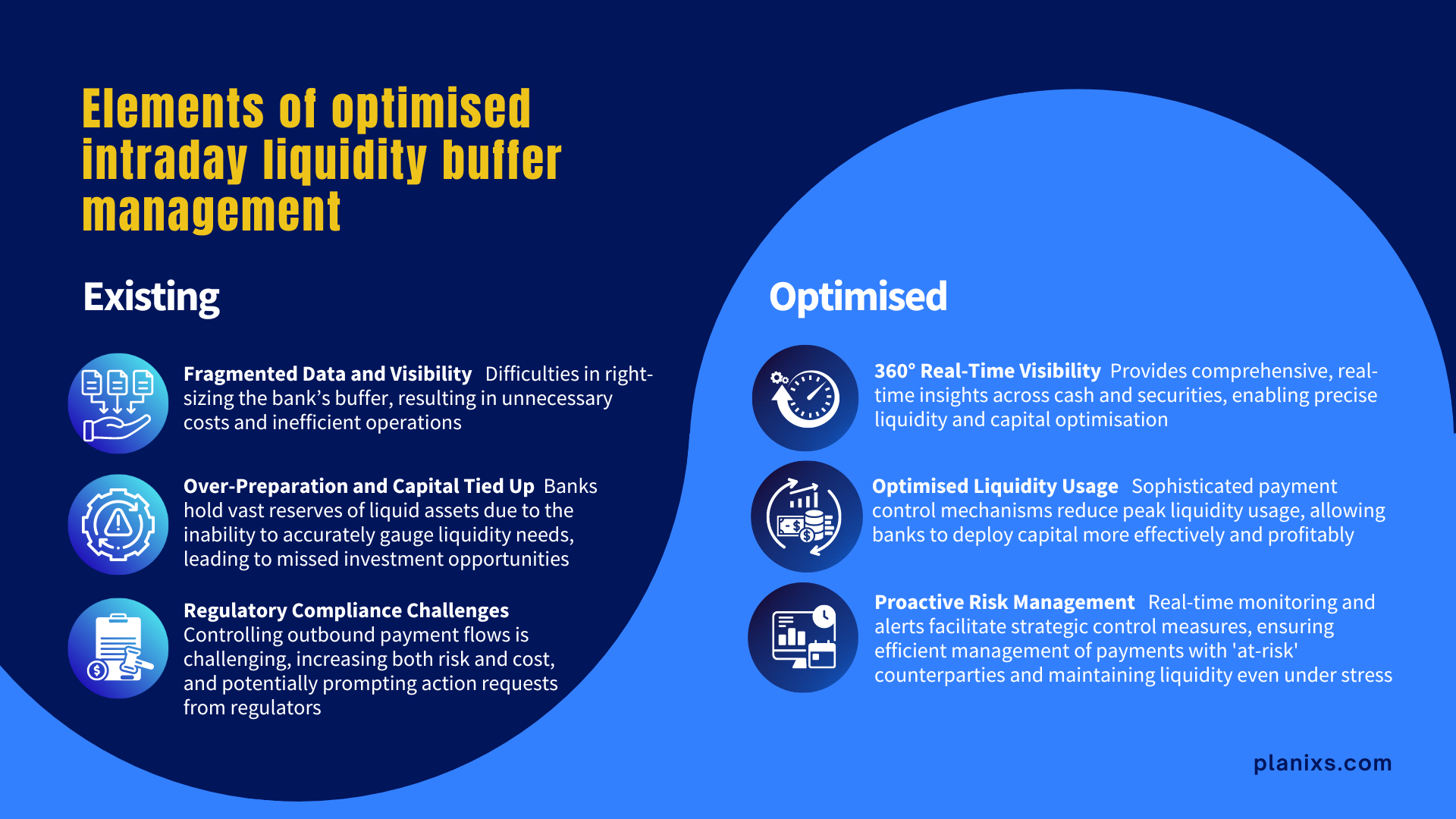

Traditional methods of liquidity management are increasingly inadequate. Banks often lack capabilities resulting in oversized buffers because they are relying on limited visibility and manual processes. The inability to integrate real-time data across multiple systems poses significant risks, including regulatory non-compliance, inefficient capital usage, and a lack of preparedness for market volatility. These risks necessitate a transition to more sophisticated, real-time liquidity management solutions.

The regulatory shift: More monitoring, more often

From a regulatory perspective, the emphasis has moved from tracking and disclosing liquidity usage only at the beginning and end of the day, to requiring firms to clearly demonstrate management of their liquidity at short notice, and at high frequency.

Firms need to show how their intraday liquidity position changes throughout the day and when “peak” daily funding requirements are likely to occur, especially under stress scenarios, if financial regulators are to have an:

“increased level of confidence in an institution’s ability to continue operating by maintaining adequate liquidity buffers and stable funding and by managing its risks effectively” [1].

This degree of visibility and control presents difficulties for many firms as they attempt to combine data from several systems in real time, so they struggle to create a comprehensive picture of their liquidity across several accounts and currencies.

Adding to this challenge are recent moves by Central Banks to encourage Direct Participants to use their liquidity buffers to support payments and market liquidity during stressed conditions. Having confidence in your data that allows your organisation to reduce the size of its buffer and release funds to the market on an everyday basis, not just in a stress scenario.

[1] European Central Bank, “ECB Guide to the internal liquidity adequacy assessment process (ILAAP) (November 2018) 2.

Liquidity buffer defined

A liquidity buffer is defined as the short end of the counterbalancing capacity under a “planned stress” view. It needs to be available outright over a defined short period of time (the ‘survival period*’). The liquidity buffer is dependent on four dimensions:

- the severity and characteristics of the stress scenarios

- the time horizon

- the characteristics of the assets in the buffer**

- the internal policy that governs the extent to which the buffer reserve can be utilised – e.g. absolute or relative use versus payments

Liquidity buffers play an instrumental role in ensuring that your organisation maintains a steady cash flow during both Business As Usual (BAU) operations and in the face of market upheavals—a market tsunami, if you will. During BAU, they provide a reliable cushion to manage routine liquidity needs and maintain operational stability. In stress scenarios, these buffers become even more critical, offering protection against the acceleration of outflows and interruptions in inflows, enabling your institution to navigate periods of financial stress without resorting to drastic measures that may hurt your long-term stability.

To visualise the importance of a healthy buffer, consider this: during adverse conditions, not only do outflows potentially increase, but the value of securities and derivatives may plummet. Liquidity buffers, comprised of cash, money market instruments, and securities, are purposely structured to absorb this shock, safeguarding your institution’s operations and commitments.

*The term “survival period” does not imply that a bank would plan only to survive for those periods, but that it would maintain buffers as “insurance” for such periods to assure its ability to cope with a crisis while taking other measures in line with its overall liquidity policies and risk appetite for longer-term survival

** Guidelines on Liquidity Buffers & Survival Periods CEBS 9 December 2009

Case studies: Transforming intraday liquidity buffer management

We are seeing a paradigm shift in how financial institutions manage liquidity and navigate the complexities of modern-day transactions. Realiti has proven its value to financial institutions (FIs) repeatedly. The insight and analytics available from this data are transformational across all business units of the bank including Treasury, Operations, Risk, Front Office and Office of the CFO.

Our mission is to supercharge banks’ treasury applications, Realiti’s software seamlessly integrates with existing technology, aggregating data from SWIFT and other systems to deliver unparalleled real-time visibility, automation, and control.

When banks come to us, we talk about ‘getting the basics right.’ A fundamental part of that is effective buffer management. The transformation in their operations has been remarkable:

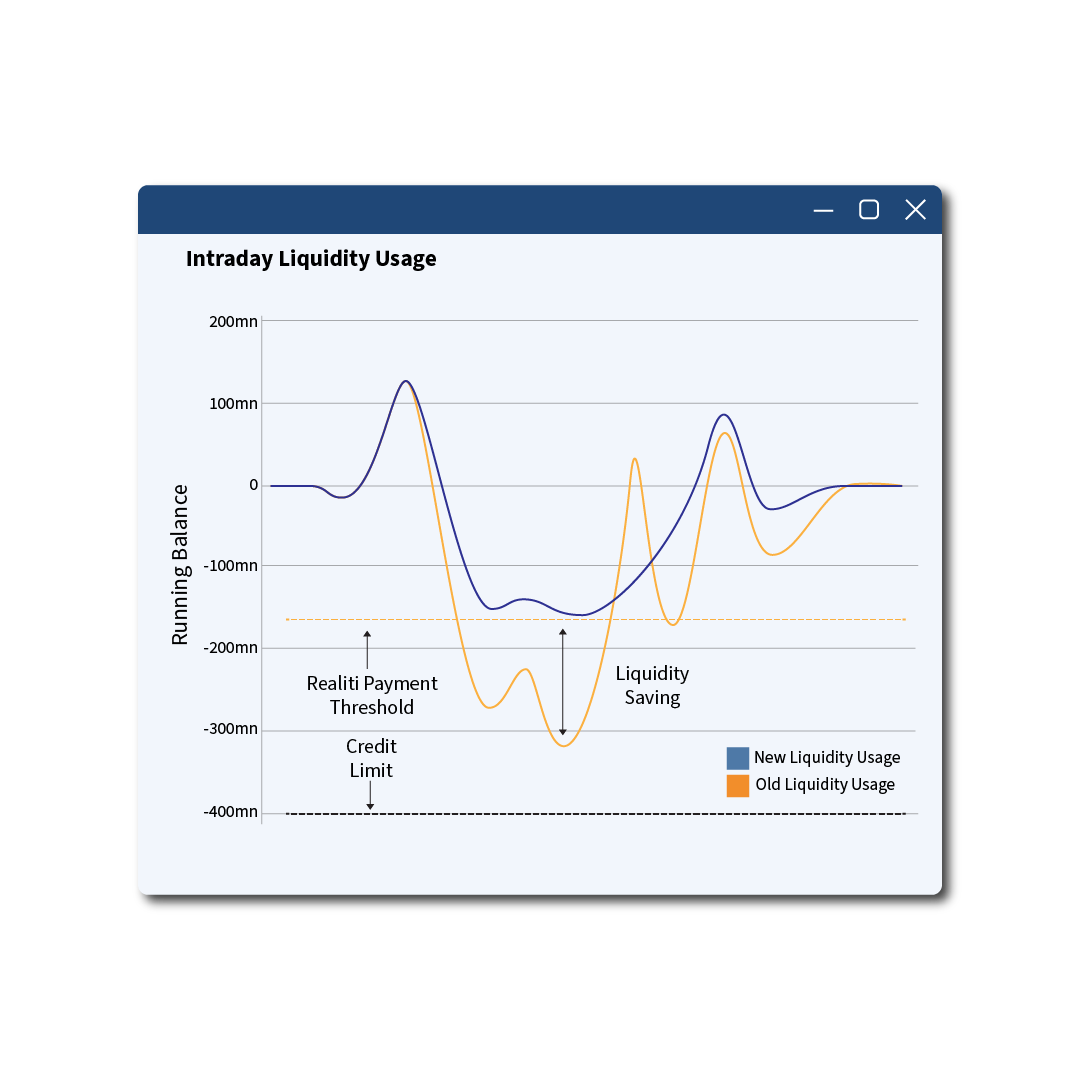

- Initially burdened with oversized buffers and regulatory add-ons due to limited visibility and manual processes, our clients have progressively adopted real-time data insights, advanced funds transfer pricing, and proactive payment control mechanisms.

- These enhancements significantly reduced their buffer requirements—saving millions in costs—and streamlined their liquidity management operations.

- The shift has led to greater regulatory compliance, improved risk management, and enhanced financial stability. Clients now enjoy a more agile and responsive treasury function, capable of navigating market changes with confidence and precision.

We have created a guide to the crucial strategies our partner banks have adopted for effective intraday liquidity buffer control.

In the guide, you will:

- Understand the five stages of intraday liquidity buffer maturity and determine your bank’s phase

- Discover how you can free up capital for more profitable use, leading to direct cost savings

- See how to identify potential shortfalls or surpluses in liquidity and take preemptive measures to mitigate risk

- Learn how effective buffer control helps avoid penalties and fosters a positive relationship with regulators

- Gain proven strategies to transform compliance into a driver for profit and growth

Realiti by Planixs provides 360° visibility across cash and securities, to enable cross-enterprise liquidity and capital optimisation. And, importantly, all in real time.

Realiti® is more than just a tool; it’s a strategic solution for banks of all sizes. Its sophisticated payment control mechanisms reduce peak liquidity usage and mitigate risks.

Real-time monitoring and alerts facilitate proactive risk management. Comprehensive data insights feed into more accurate FTP models, allowing banks to optimise liquidity usage.

Optimised intraday liquidity buffer management

Imagine being in a constant state of over-preparation, where your institution holds vast reserves of liquid assets that could otherwise be invested more profitably. This over-cautious approach not only ties up capital but also reflects a lack of confidence in the bank’s liquidity management practices. If you have not got accurate, reconciled data it can make it impossible to pass back costs to the appropriate business unit.

Regulators want you to be able to manage payments with ‘at-risk’ counterparties through strategic control measures, ensuring liquidity is maintained even under stress. To become proactive, businesses should frequently evaluate their operational cash flows, conduct stress tests to simulate worst-case scenarios, and adjust their liquidity buffers accordingly.

Instead of viewing liquidity buffers merely as a backstop, proactive companies integrate these practices into their BAU processes. They use predictive analytics to anticipate market changes, allowing them to adjust their buffers well before a crisis hits, ensuring they are always prepared rather than responding to problems as they arise.

In this paradigm shift, businesses continuously replenish their liquidity buffers, streamlining their financial health and ensuring that they are always a step ahead. This approach mitigates risks and promotes a culture of financial resilience and strategic planning.