Enhance resilience with automated stress testing

Simulate stress scenarios, assess liquidity readiness, streamline compliance with regulators, and optimise your processes.

The Challenge

Defining and managing stress events is essential for banks to ensure resilience against potential financial pressures. This involves simulating various stress scenarios, assessing the bank’s ability to withstand these stresses, and adjusting the liquidity buffer accordingly.

Convincing regulators of the bank’s control over its liquidity requirements is crucial to avoid the imposition of expensive buffer add-ons. However, accessing the necessary data from multiple sources, conducting thorough stress tests, and integrating these practices into daily operations can be labour-intensive and challenging.

The Solution

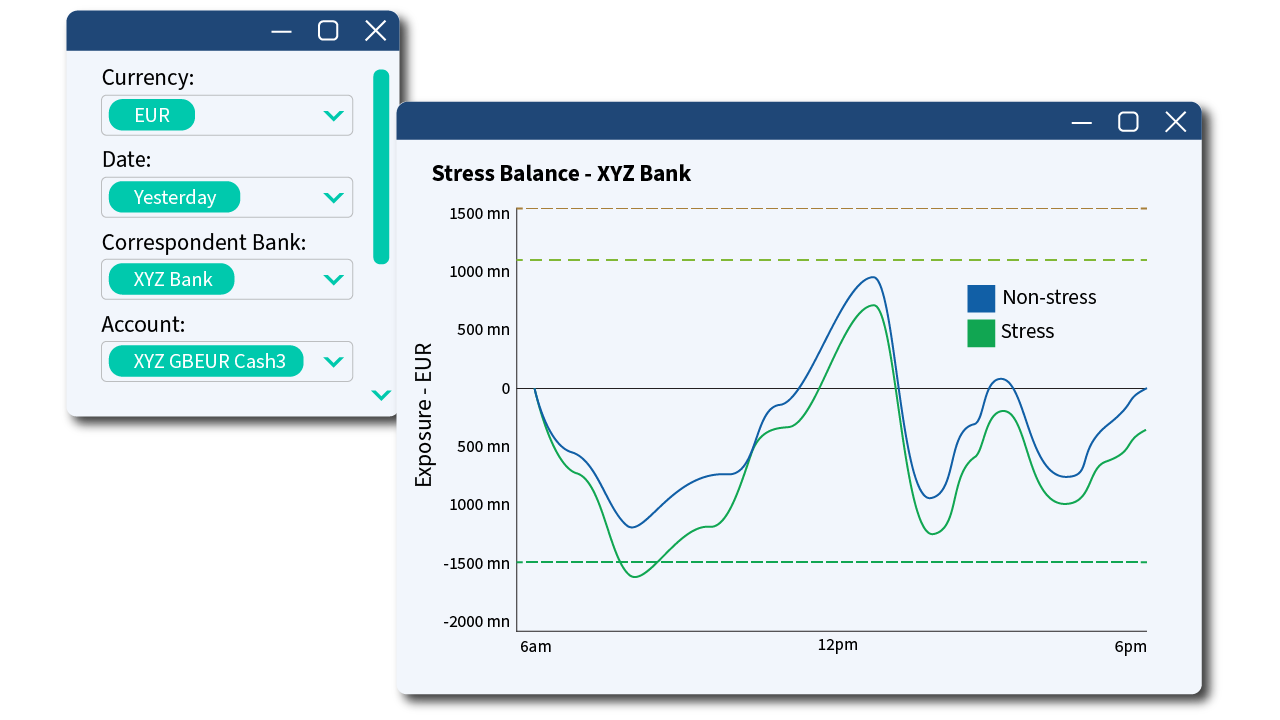

Realiti automates the stress testing process, aligning with BCBS248 requirements. By using actual payment, receipt, and liquidity data from baseline days, Realiti applies stress scenarios to generate new data streams that reflect potential stress conditions. This enables comprehensive analysis using the Realiti’s front-end tools including intraday balance charts and regulatory reports, showing how liquidity usage changes under stress.

Automation allows banks to conduct frequent and detailed stress tests, proving to regulators that they can prepare for, identify, monitor and ultimately manage through liquidity stresses. This also helps:

- Identify appropriate buffers to cover peak intraday liquidity usage even under stress

- Ensure continued access to liquidity

- Ensure ability to meet payment obligations during stress events

- Optimise the bank’s liquidity management

- Eliminate the need for costly buffer add-ons

- Potentially save millions per year