Optimise funding with cash management and sweeps

Achieve accurate forecasting of end-of-day balances, and minimise overnight funding costs with seamless integration of forecasted and actual activities.

The Challenge

Accurately forecasting end-of-day balances and effectively funding accounts are critical for banks to minimise overnight funding costs and reducing risk associated with long balances. However, reliance on assumed funding models (where all transactions are assumed to have settled perfectly) and a lack of real-time visibility into actual settlements make it difficult to achieve accurate funding.

Data silos and lack of integration between forecasted and actual activities further complicate the process, leading to frequent inaccuracies. High interest rates exacerbate the issue, significantly increasing overnight funding costs.

The Solution

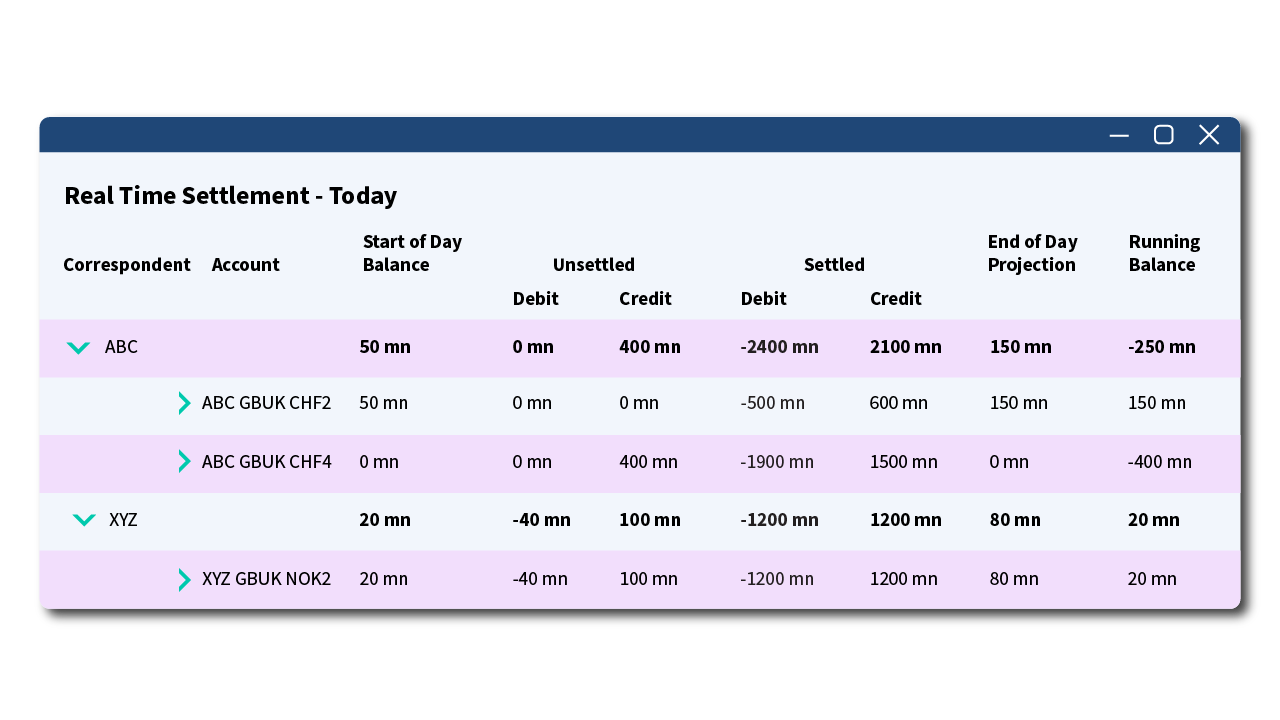

Realiti provides a real-time, reconciled view of forecasted and actual account activities, highlighting settled and unsettled transactions. This enables banks to shift from assumed funding models to actual funding models, improving accuracy and reducing costs. Users can interact with the data and make necessary adjustments throughout the day as real-world events occur.

The benefits include:

- Automating the process of squaring accounts denominated in the same currency

- Reduced manual effort

- Minimising the risk of missed opportunities

- Enabling liquidity cost savings through end-of-day balance analysis

- Improved funding accuracy, leading to significant financial benefits