The European Central Bank’s (ECB) new guidelines on intraday liquidity risk management represent a critical shift in how banks must approach liquidity controls.

While these guidelines raise the bar for compliance, they also present significant challenges for banks that lack the necessary processes, infrastructure, or technology. Planixs’ Realiti platform is the ideal solution to help banks not only meet these stringent requirements but also enhance their overall operational efficiency and resilience.

The Challenge: ECB’s Intraday Liquidity Guidelines

The ECB’s recent announcement introduces new expectations across key areas of intraday liquidity management:

- Real-Time Monitoring: Banks must track liquidity positions across currencies and accounts continuously.

- Dynamic Forecasting: Projections must adapt in real-time to reflect changing market conditions.

- Payment Control: Capabilities to prioritise and throttle payments are essential.

- Stress Testing: Daily stress tests and dedicated intraday liquidity buffers are required for intraday resilience.

- Governance: Clear roles, escalation processes, and robust reporting frameworks are mandatory.

For many banks, meeting these requirements will require significant changes to their existing processes and systems. Realiti provides the tools to make compliance seamless while delivering tangible business benefits.

How Realiti Aligns with the ECB’s Guidelines

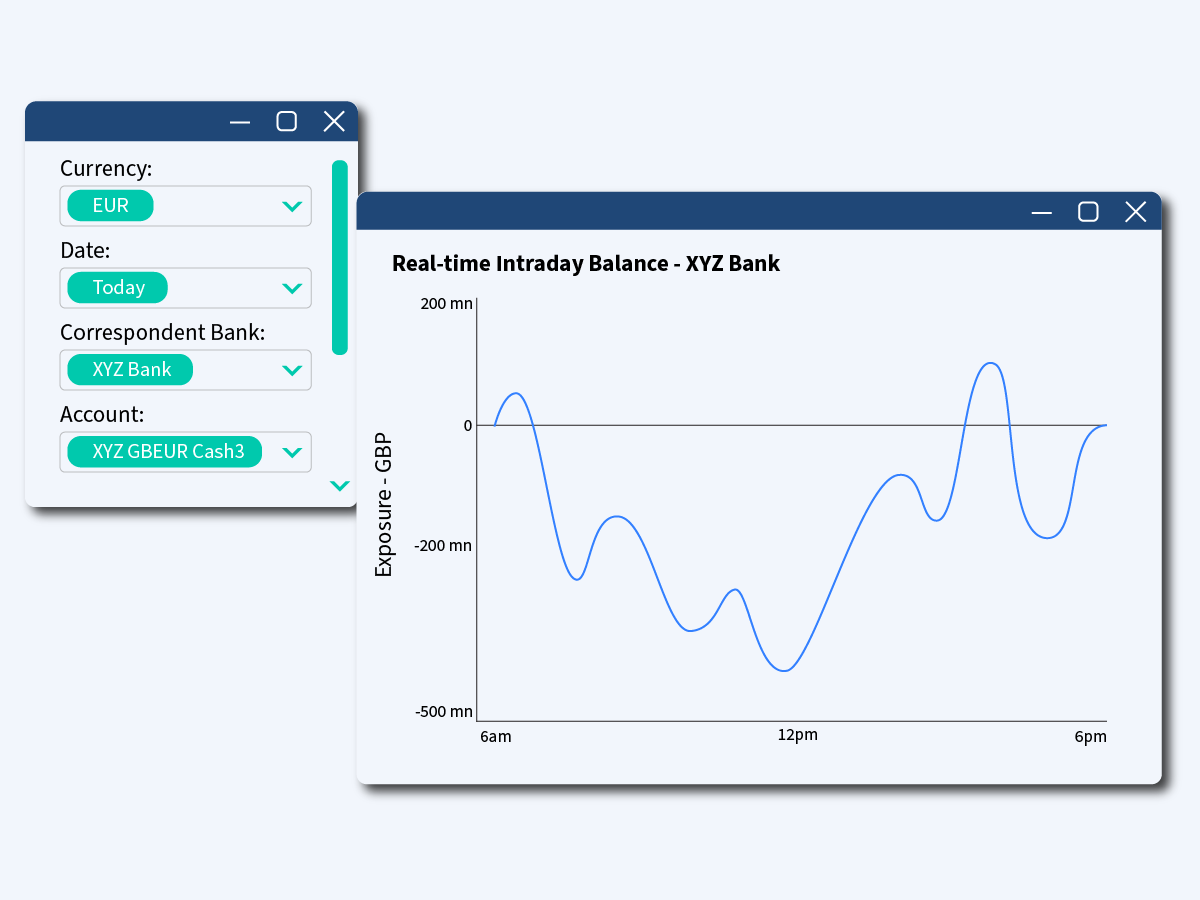

1. Real-Time Monitoring and Reconciliation

ECB Requirement: Continuous monitoring of cash, securities, and collateral positions across all currencies.

How Realiti Helps:

- Offers real-time visibility of intraday liquidity across all accounts, currencies, and counterparties.

- Combines cash and securities intraday profiles

- Automates reconciliation between forecasts and actual transactions, ensuring alignment throughout the day.

- Enables proactive decision-making with customizable alerts for liquidity breaches or unexpected activity.

2. Dynamic and Accurate Forecasting

ECB Requirement: Forecasting tools that use real-time data to predict liquidity needs and adjust dynamically.

How Realiti Helps:

- Utilises advanced analytics to provide accurate, dynamic forecasts based on real-time and historical data.

- Integrates predictive modelling to anticipate payment flows and changes in liquidity conditions.

- Improves operational preparedness through real-time updates to forecasts as the day progresses.

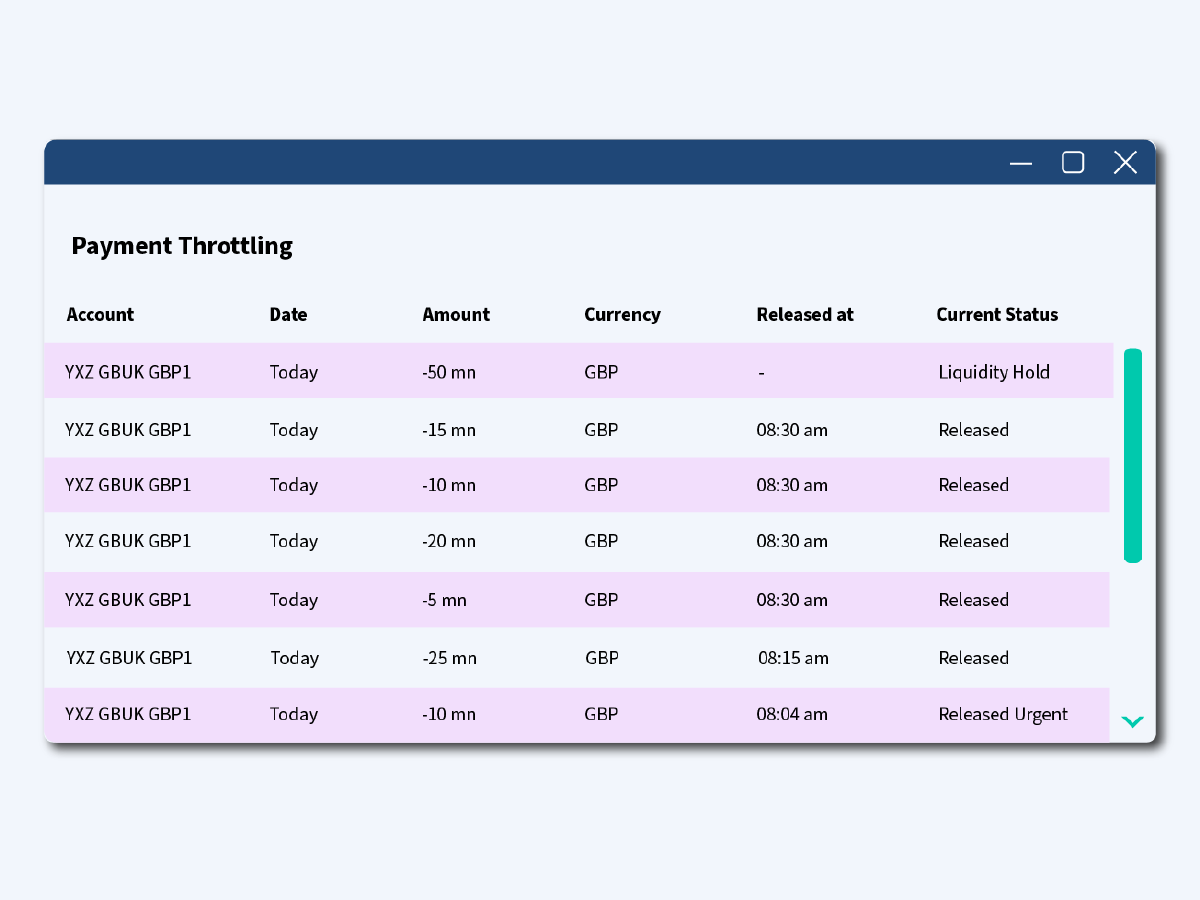

3. Payment Prioritization and Throttling

ECB Requirement: Capabilities to manage and prioritize payment outflows during both BAU and stress.

How Realiti Helps:

- Enables banks to prioritize critical payments and delay non-essential transactions when needed.

- Ensures compliance with regulatory requirements for time-sensitive and critical payments.

- Reduces systemic risks with tools to manage payment flows dynamically.

4. Comprehensive Stress Testing and Buffer Management

ECB Requirement: Daily stress tests to validate intraday liquidity buffers across all currencies.

How Realiti Helps:

- Automates intraday stress testing across multiple scenarios, including currency-specific disruptions and payment delays.

- Helps determine the optimal size of liquidity buffers, avoiding over- or under-allocation.

- Provides daily insights to ensure banks are prepared for both expected and unexpected liquidity demands.

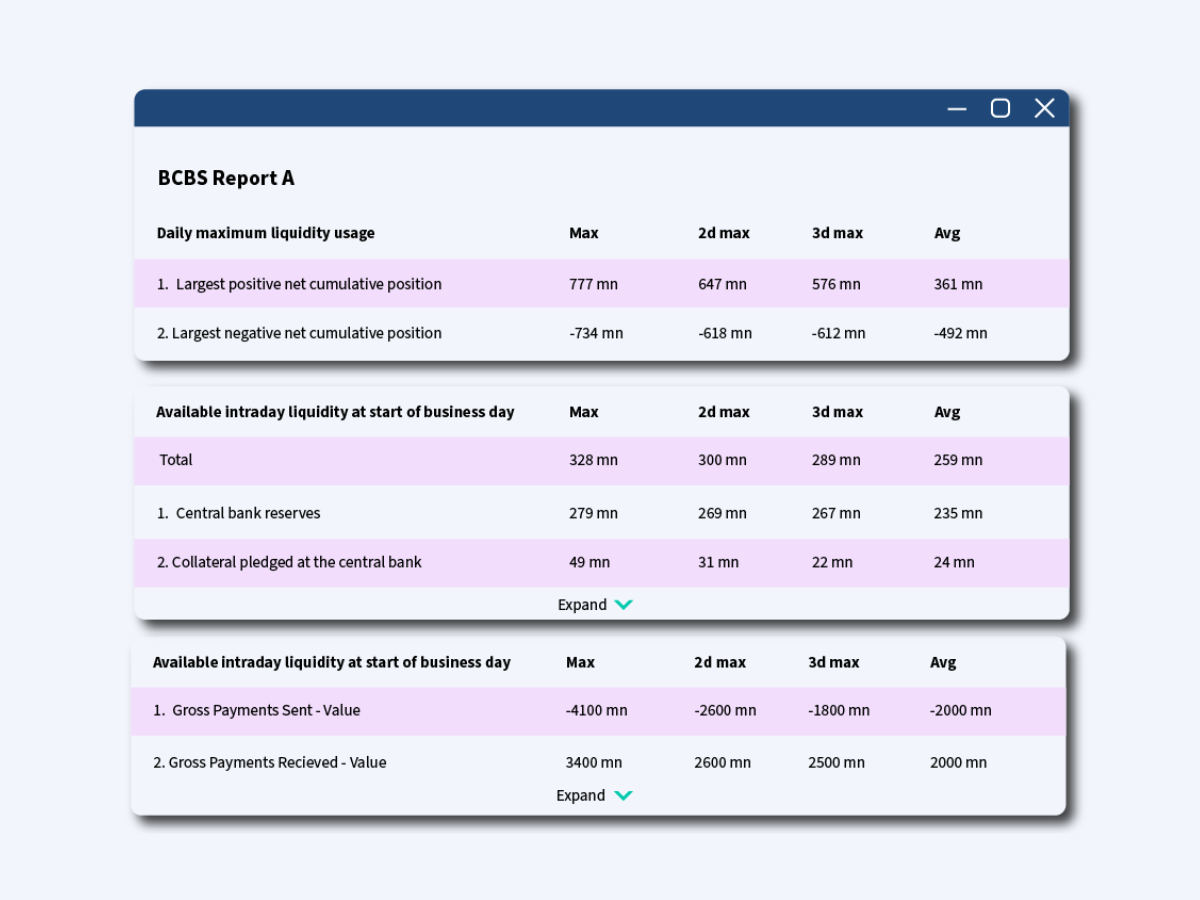

5. Governance and Reporting

ECB Requirement: Robust governance structures, escalation procedures, and detailed reporting.

How Realiti Helps:

- Facilitates clear governance with a shared platform for Treasury, Operations, and Risk teams.

- Automates escalation workflows to ensure timely responses to breaches or issues.

- Generates comprehensive reports to demonstrate compliance and operational readiness to internal stakeholders and regulators.

Why Choose Planixs and Realiti?

The ECB’s new guidelines are not just a compliance challenge—they’re an opportunity to build a more resilient and efficient liquidity management framework. With Realiti, banks can achieve this by:

- Simplifying Compliance: Realiti translates the complex requirements of the ECB into actionable, automated processes.

- Improving Efficiency: Real-time insights and Realiti’s automation eliminate manual processes and reduce operational risks.

- Unlocking Strategic Value: Enhanced data visibility and forecasting allow banks to optimize liquidity usage, reduce costs, and improve profitability.

- Future-Proofing Operations: Realiti equips banks with the tools to adapt to evolving regulatory landscapes and market conditions.

Act Now: Turn Challenges into Opportunities

The ECB’s announcement marks a turning point for intraday liquidity management. For banks that act quickly, it’s an opportunity to strengthen their operations, improve decision-making, and gain a competitive edge. Realiti is the proven solution that delivers these outcomes.

Arrange a call to learn how Realiti can help your bank meet the ECB’s requirements and transform your approach to intraday liquidity management. Let’s discuss your specific needs and how we can partner to achieve compliance and operational excellence.

Alternatively, you can see Realiti in action by watching a demo here.