Real-time cash and liquidity management for smarter banking

Gain visibility and full control of your liquidity and cash flows—all on one powerful platform. Meet Realiti.

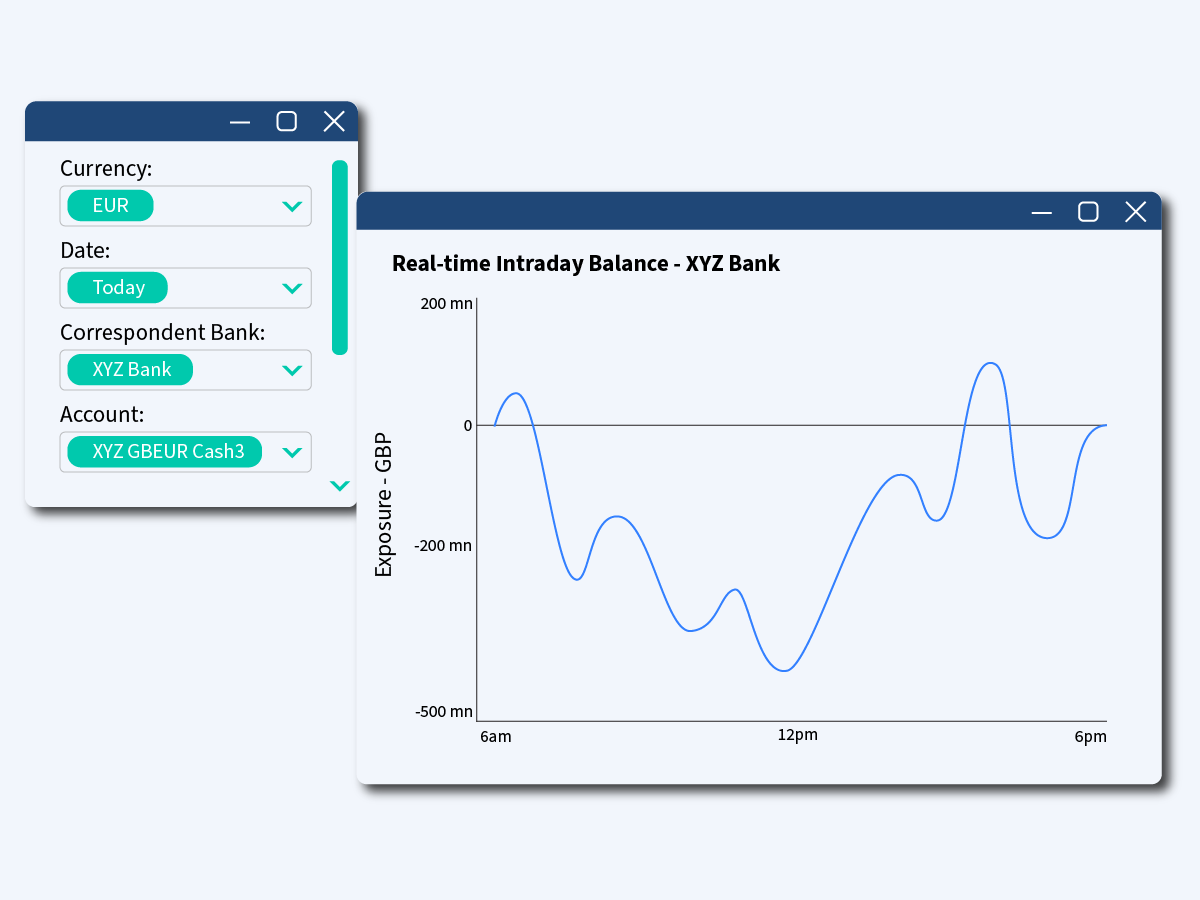

Intraday Balance Visibility

Gain intraday balance visibility with all your bank account data into one platform. Automate your liquidity management, optimise costs, and enhance real-time control.

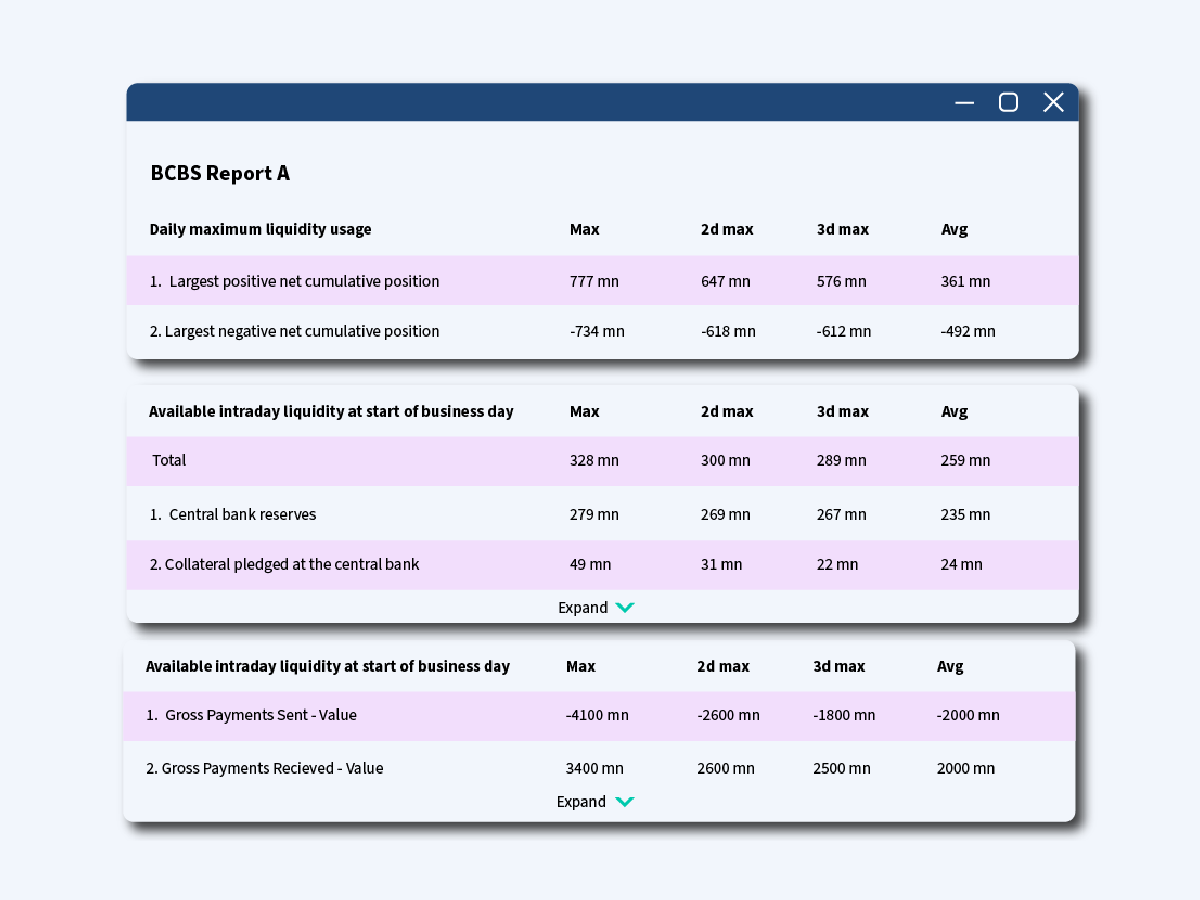

Regulatory Reporting

Automate regulatory reporting, streamline compliance and gain insights into intraday client liquidity. Meet requirements with accuracy, reduce manual effort, and respond swiftly.

Stress Testing

Automate stress testing, simulating scenarios to assess liquidity readiness and regulatory compliance. Optimise your processes, reduce risks, and improve resilience

Cash Management and Sweeps

Optimises funding with real-time visibility into forecasted and actual activities. Minimise overnight costs and improve funding accuracy.

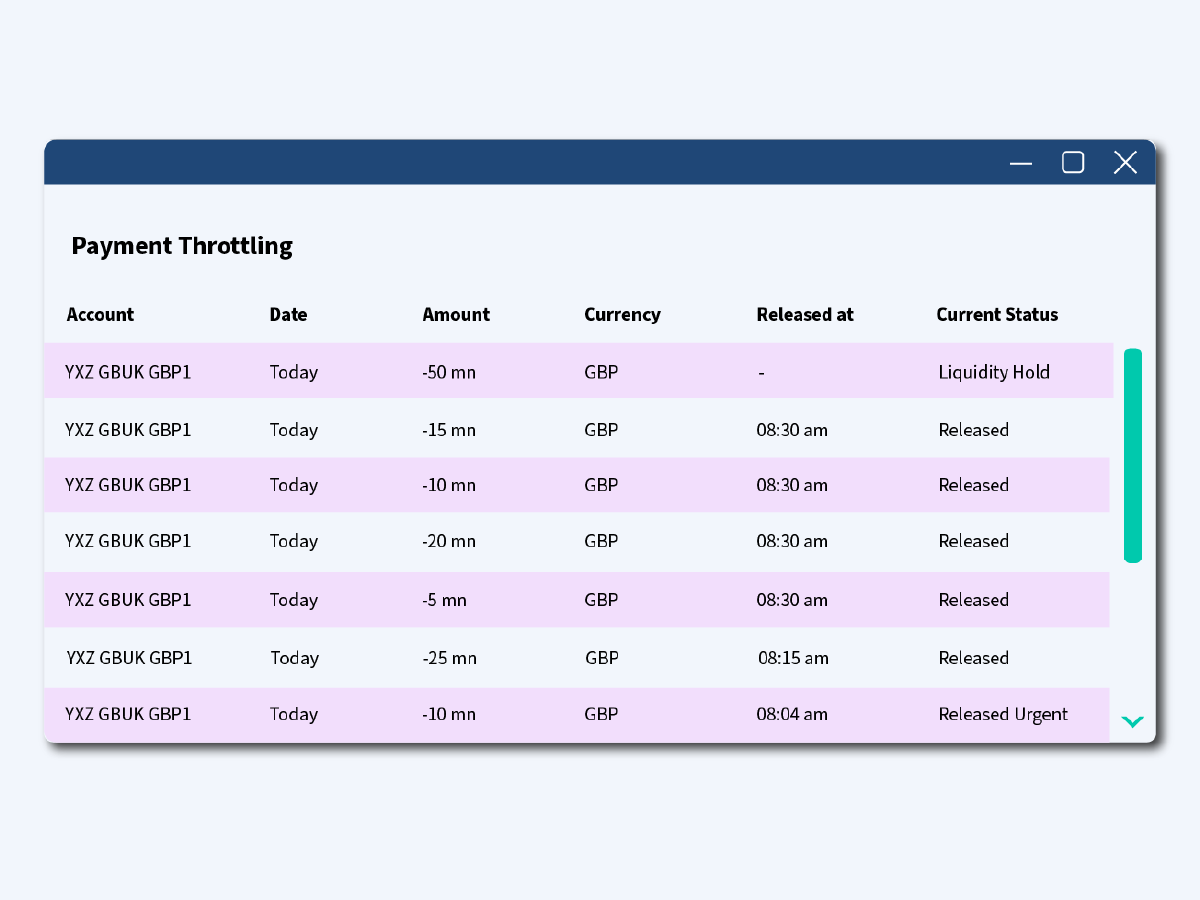

Payment Throttling

Reduce costs with intelligent payment throttling, allowing you to manage payment flows, prioritise obligations, and minimise liquidity usage while reducing risks

Visibility of Securities

Gain real-time visibility of securities, with up-to-the-minute insights into asset holdings, locations, and values. Improve liquidity management and informed decision-making.

Intraday Client Liquidity Usage

Gain insights into intraday client liquidity usage, helping you monitor account behaviors, identify unusual settlement patterns, and optimise resource allocation for better decisions.

Monitoring and Alerts

Automate monitoring and alerts for actual and forecast account balances with real-time visibility. Identify risks, manage stress events, and improve efficiency.

Realiti Insights - Liquidity Data

Transform the way you use your liquidity data with Realiti Insights for real-time efficiency, cost savings, and enhanced risk management.

“We are very excited about deploying Realiti and experiencing the benefits across our liquidity management processes. Furthermore, we are really pleased to have found a strategic partner in Planixs that we can work with to transform our treasury operations.”

Ross Morgan Head of Department, CFO Division Treasury Middle Office & Operations